Last Friday Qontigo announced an update to its DAX Index, the leading benchmark index on German equities, expanding the number of constituents from 30 to 40 stocks. The change will become effective on 20 September 2021 and the additions to the DAX Index are:

- Airbus (aerospace manufacturer)

- Zalando (fashion e-commerce)

- Siemens Healthineers (medical technology)

- Symrise (producer of flavours and fragrances)

- HelloFresh (fresh meal delivery kits)

- Sartorius (life science technology)

- Porsche Automobil (luxury carmaker)

- Brenntag (chemical distribution)

- Puma (sportswear)

- Qiagen (medical sample and assay technology)

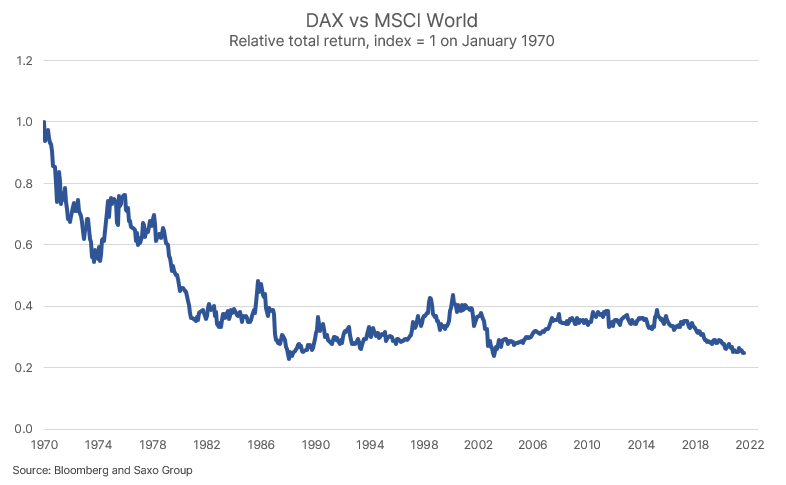

As the list above shows, the additions will tilt the DAX Index away from its classical roots in heavy industry, carmakers, banks, insurance, utilities and chemicals. The additions are higher growth companies with interesting business models. More importantly the change is needed as the DAX Index has significantly underperformed the MSCI World (which is 65% US equities) since March 2015 and has generally underperformed global equities for 50 years straight. One of the reasons for the chronic underperformance is the low return on equity (ROE) of German companies which currently is 11.1% for the DAX Index, which is also the problem for Japanese companies something we highlight in our analysis of Japanese equities in yesterday’s equity note. S&P 500 is at 17.2% ROE and Nasdaq 100 is at 26.9%. It is clear that the DAX Index is not representing the newest industries and the highest quality companies compared to the US equity indices. Hopefully the expansion of the DAX Index can change that.

Germany has always been seen as a leader in industrial technology with some of leading companies in various industries from Volkswagen, Siemens, BASF and Linde. While Germany did have some leadership in the digitalization with SAP pioneering the enterprise resource management systems that enabled multinationals to consolidate accounting across many subsidiaries, inventory management, and human resource, Germany has fallen behind in the digitalization losing out to the US. In a recent Reuters special report on Germany’s digital gap, the various embarrassing gaps are spelled out with one being internet connection with Germany ranking 29th out of 34 industrialised economies. Germany essentially lost the current technology vectors of software and biotechnology, and recently its car industry is being attacked by Tesla and other Chinese electric vehicles makers.

* Peter Garnry owns shares in HelloFresh