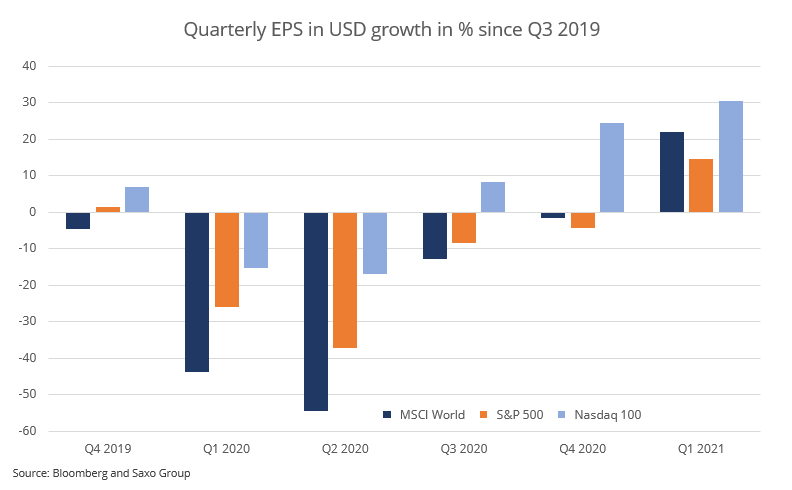

Earnings releases are continuing this week at a blistering pace with focus shifting away from the US towards Europe and especially Chinese technology earnings as data shows that Ark Invest has increased their allocation to Chinese companies such as Alibaba and JD.com. Q1 earnings have been strong and global corporate earnings are well ahead of pre pandemic levels with the biggest recent surprise being global earnings growth outside broader US equities and US technology sector. The rally in commodities and higher interest rates are driving the current rotation out of growth and into value stocks which benefits Europe and emerging markets on a relative basis.

The list below shows the most important earnings to watch this week and the ones in bold are those that can move market sentiment or at least their industry group. The key earnings day will be on Thursday with many key earnings in the technology industry from both China and the US. Airbnb will be interesting because many travel related stocks have not been aggressively bid during Q1 as many of the companies in this industry have signaled slower rebound pace in travel activity than expected a few months ago. In terms of electric vehicles demand out of China Li Auto and Xpeng will be key to watch, and especially for those with exposure in Tesla as China is the US carmaker’s most important market. Today, Panasonic has already reported its FY21 earnings (ending 31 March), which we cover in today’s Saxo Market Call podcast, showing strong outlook for its barriers under the Automotive segment.

- Monday: ITOCHU, Panasonic, Duke Energy, Air Products and Chemicals, Marriott International, BioNTech

- Tuesday: KBC Group, E.ON, SoftBank Corp, Takeda Pharmaceutical, Nissan Motor, Electronic Arts, Palantir Technologies, Unity Software

- Wednesday: Verbund, Fortum, EDF, Allianz, Merck, Bayer, RWE, Toyota Motor, SoftBank Group, Compass Group, Iberdrola, Li Auto

- Thursday: Brookfield Asset Management, Alibaba, Walt Disney, Bilibili, Xpeng, Airbnb, DoorDash

- Friday: Honda Motor, JD.com

Steelmakers are almost a bigger winner than e-commerce

As we talk about in our podcast today, iron ore prices were limit up in China today and it seems the demand is not only speculative but that of real demand, but even more importantly, steelmakers are able to pass on the rising input costs to customers. This paves the way for even higher iron ore prices. Global steelmakers are up 248% since 23 March 2020 compared to 276% for our e-commerce basket suggesting that the big winners of the pandemic might soon be shifting from the digital to non-digital parts of the economy. Who would have thought? The chart below shows global steelmakers’ total return performance relative to that of the MSCI World.

S&P 1200 Global Steel Sub-Industry vs MSCI World Index (total return in USD)

Will public health crisis squash private property rights?

Last week was brutal for vaccine winning companies such as Curavac, Moderna, and BioNTech, as the Biden administration announced last Wednesday that it supports waiving intellectual property protections for Covid-19 vaccines. It would correctly speed up production, but it would also undermine a key leap in medical technology and economically punish the intellectual breakthrough of the biotechnology companies. With BioNTech alone expected to profit $5.75bn in 2021 the political system has these companies on their target as the vaccine rollout as been slow. Merkel’s government has rightly said that a waiver is not the right solution, and we guess the US government is playing a political game to get better terms from BioNTech and Moderna. Our thinking is that the model going forward could be something like forcing these companies to lower their prices, but then helping them get public subsidies for expanding production capacity. This model would protect the mRNA IP which these companies can use for other key drugs in the future, but also ensure lower prices for the developing world and faster production ramp-up.