FX Trading focus: EUR continues to wilt. NOK charges higher despite left

The euro continue to drop in the wake of last week’s indifferent ECB meeting, with EURUSD dropping today toward its last major local Fibonacci retracement level of the recent rally – the 61.8% retracement at 1.1758. Below that, and the pair opens up the range toward the sub-1.1700 lows. Elsewhere, the risk-off pattern established late Friday in FX that continued overnight has eased during Europe today as the JPY and CHF backed off a bit lower (USDJPY has become a farce and practically looks managed at this point – given the upcoming election in Japan, watching the situation closely there). I still feel the next step for more volatility is something unfolding in the rates market, with the rise in US treasury yields early last week quickly beaten back in the wake of strong treasury auctions on Wednesday and Thursday, only to see yields rising curiously on Friday despite a very risk-off session. In short, we need to keep an eye on the US treasury curve.

Norwegian election today, with much theoretically at stake. The polls suggest that the Conservative-led center-right coalition is set to lose in favour of a center-left coalition, led by the Labour party and likely including the euro-skeptic Center party and the more left-leaning Socialist left party. The Labour party has spoken against any rapid wind-down of fossil fuel energy commitment and is likely to aim for a controlled exit over a long timeframe for the sector, with investment in a green transition, etc. The key difference maker for whether we can quickly get beyond any near term uncertainty is whether the three parties receive a sufficiently strong result to manage a majority government. If not, the coalition negotiations could get drawn out as the Greens and/or Reds, with the latter an outright Marxist party while the former wants to completely wind down the fossil fuel industry by 2035 and has vowed not to support any government that won’t support its position. At the moment, NOK trades seem to fear little from the political outcome and have both eyes on current oil and especially gas prices. By the way – on the latter, please note my comments on the Russian central bank meeting and next steps for the ruble – if the gas gets flowing in a big way through the NordStream2 pipeline and takes record European natgas prices back into their previous range, this is a net negative for NOK, as Norway is reaping far more revenue at the moment from gas than oil. Month-forward natural gas prices in Europe are currently over three times their 200-week moving average.

Chart: EURNOK

NOK is gunning for new local highs against the euro and the Swedish krona (where parity has been in play today in NOKSEK) as the Norwegian election ends today. As noted above, investors don’t seem to be fretting any imminent shift away from investment in fossil fuels despite the nearly certain shift leftward in the new government after this election. There is the risk of a drawn-out period of uncertainty if the centre-left underperforms the polls and has to bargain for support for a minority coalition, but for now, EURNOK is gunning below the 10.20 pivot are that theoretically opens up for the massive 10.00 level again, provided politics or risk sentiment down throw up any obstacles. Interesting to see if Norges Bank eases up on the hawkish guidance if NOK aggressively bid into next week’s Norges Bank meeting and the expected rate hike it will bring.

Russian Central Bank hikes less than expected as it only raised rate 25 basis points rather than the widely expected 50 basis points, taking the policy rate to 6.75%. This comes after the big 100 basis point hike in the previous decision. Initially, the market took this as dovish, but it appears the Russian Central Bank is playing the game of softening its guidance while still keeping it in the direction of further tightening by indicating that it would likely tighten again in a coming meeting. This keeps their inflation-fighting credibility intact while at the same time perhaps signaling that it wants to downshift a bit to see whether the policy hikes in the bag are having the desired effect of slowing inflation in coming months. Forward rates were practically unchanged in the wake of the decision. As I mentioned on Friday, a key next step for ruble traders would be the green light from German regulators allowing natural gas sales via the just completed Nord Stream 2 pipeline – bullish RUB on the implications for new revenue streams while less so if the news quickly impacts record high natural gas prices in Europe ahead of the winter.

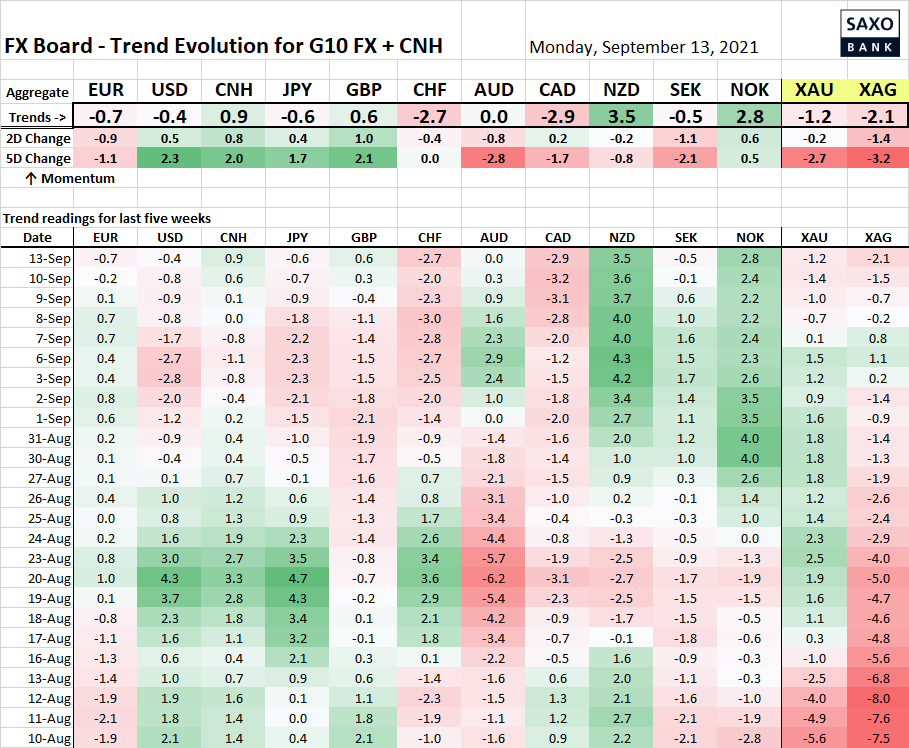

Table: FX Board of G10 and CNH trend evolution and strength

Note that NOK strength at odds with CAD weakness on the oil-correlation theme, although Norway’s rate expectations continue to stretch higher, while they have flattened for Canada for weeks. More volatility across the market needs to see the US dollar on the move.

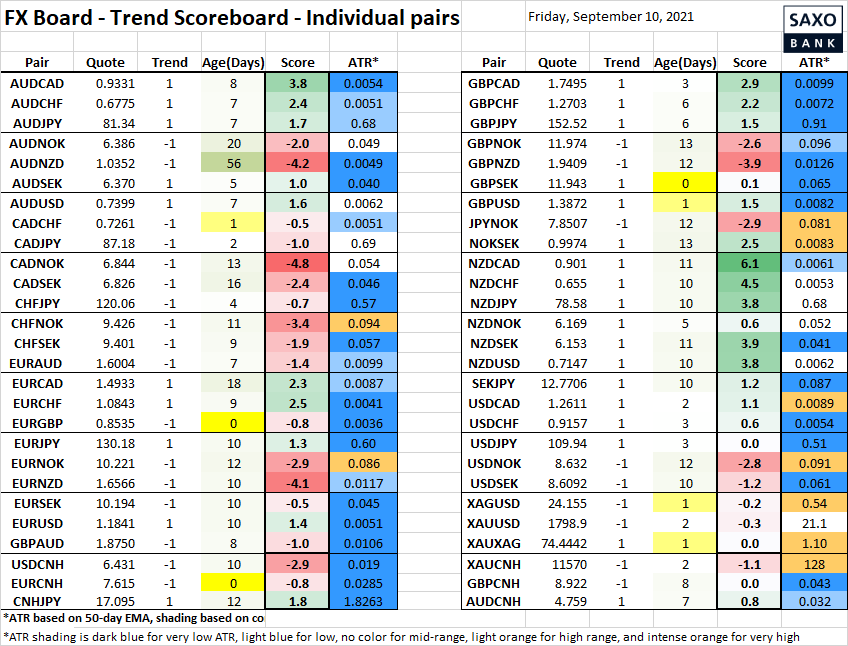

Table: FX Board Trend Scoreboard for individual pairs

Here it is worth noting the EURJPY and EURUSD bidding to turn to a negative “trend” again (note Fibo level of 1.1758 in EURUSD), while the AUDNZD downtrend at 57 days is starting to look remarkably long in the tooth and needs more fuel to keep going – not getting it with news of new covid cases in New Zealand at the weekend. USDCHF is worth a look for further developments as it is rallied hard today and is trading up near the two-month highs.

Upcoming Economic Calendar Highlights (all times GMT)

- Norway election

- 2100 – South Korea Aug. Import/Export prices

- 0000 – Australia RBA’s Ellis, Jones to speak

- 0130 – Australia Aug. NAB Business Conditions/Confidence

- 0245 – Australia RBA Governor Lowe to speak