Macro Dragon = Cross-Asset Quasi-Daily Views that could cover anything from tactical positioning, to long-term thematic investments, key events & inflection points in the markets, all with the objective of consistent wealth creation overtime.

(These are solely the views & opinions of KVP, & do not constitute any trade or investment recommendations. By the time you synthesize this, things may have changed.)

Macro Dragon WK #26:The Week After the Fed Hawkish Pivot…

Top of Mind…

- TGIM & welcome to WK #26…

- Despite the title, we’ll cover the thoughts & potential pathway from last wk’s FOMC meeting on a different thread later this Monday Asia – so look out for a Macro Reflections piece… It was just getting too long for a wk ahead piece

- Suffice to say, risk-off is the name of the game equity wise in the Mon Asia Midday Session… a slight pop in AUD 0.7489 +0.13% & NZD 0.6955 +0.27% post the beatdown they got last wk at -3.0% to 0.7479 & -2.7% to 0.6936, respectively.

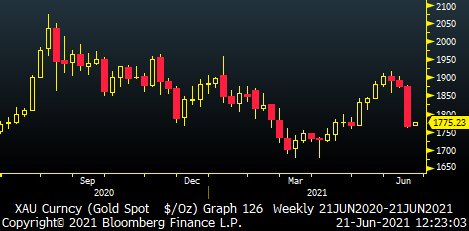

- Gold 1774 +0.57% trying to bail water out of the flooded ship, post last wk’s -6.0% to 1764…

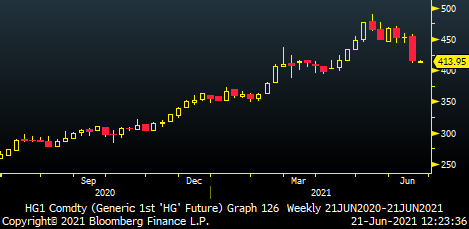

- …& ditto on copper than finished last wk at -8.4% to 415.

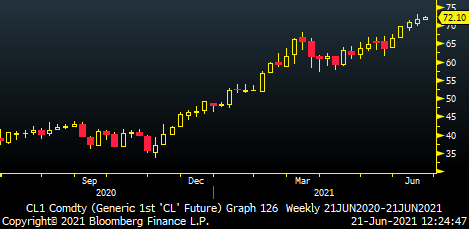

- And as always Oil completely not giving a fudge & ticking up +0.50 to +1.0% after finishing up last wk. Clearly oil – for now at least – could not spell hawkish Fed if you held its hands. Still think Oil could easily do -5% to -15% & still be in a bullish Ascension. It has been pretty much relentless since Nov of last year – was interesting to see energy names like etf XLE $52.39 pullback by -5.4% last wk.

- The theme this wk is going to be digestion of the Fed & its implications, as well as have some flash PMIs, BoE, FOMCs speakers & Powell set to speak on Tues (Wed 0200 AM SGT).

- Eight key question for cross assets & markets to consider:

- Have the moves from last wk completely repriced us for a Hawkish Fed from a cross-asset perspective?

- Have the moves from last wk overshoot from a cross-asset & themed perspective?

- Have the moves from last wk undershoot, either from a few lagging securities like say BRL or TWD and/or we are just getting started in regards to USD bulls positioning?

- Is the reflation theme dead, or is this a beautiful place to add onto some of the cyclicals likes financials?

- Will the Fed have to potentially do another 180 degree turn closer to Jackson hole, as it seems that the Biden|Harris Administration may not be able to do as much fiscal as we envisaged from just 4-8wks ago?

- A lot of key technical weekly closes from last wk, so regardless of one’s thoughts on fundamentals are these about to be new emerging trends or false break-outs, or a mix of both depending on asset class & underlying play within that asset class?

- Why were things like financials selling off, if we are hiking rates – shouldn’t banks do well in that environment?

- Is there a chance that the Fed is pivoting towards being hawkish right when we are seeing maximum growth in the US & potentially peak inflation given base effects fall off & almost half of the components from US CPI rises from the last two readings had to do with temporary factors of second hand car prices?

Rest of the Week & Other Reflections

- Econ Data: Econ data is light this wk, we got flash PMIs across the board, with the US seeing final GDP & durable goods readings set to come through.

- CB: BoT 0.50% e/p BSP 2.00% e/p BoE 0.10% e/p (yet taper is key risk, yet we are still delayed on reopening) MX 4.00% e/p

- Fed speak: Tons of speakers with a few dovish FOMC speakers kicking off the wk, key focus will be Powell Tue testimony (Wed 0200 AM SGT/HKT)

- ECB|EUR: Lagarde speaking twice on Mon & once on Wed

- Hols: No major hols on the agenda

- Dragon Interviews U-Tube Channel for easier play-ability… Check out our recent Crypto Interview with The Spartan’s Group Casper B. Johansen & yes, the increased volume for regulation coming out of the US is actually a massively positive structural aspect for the space. Translation: Regulation of Crypto = Acceptance of Crypto.

–

Start<>End = Gratitude + Integrity + Vision + Tenacity | Process > Outcome | Sizing > Position.

This is The Way

Namaste,

KVP