The fear of a bear market keeps many investors up at night.

They get caught up on the thought that it could happen any day — a sudden 20% plunge in the stock market. There could be a three- to four-year bear market. They worry that stocks are going bankrupt.

How do you invest in a time like this?

Well, as options traders, the answer is always simple — you keep following your strategy.

That’s right.

I don’t have to flinch when it comes to bear markets. Whether the dips are short-lived like we saw earlier this year or a prolonged decline like we experienced from 2007 to 2009 … a sound strategy will keep trading profitable options in any market.

Because one type of option allows us to profit from the pullbacks.

If a stock is going to zero, we can profit from it. If the stock market is in freefall, we can rack up triple-digit gains just as easy.

This week, I’ll explain how put options can deliver fast profits even in the worst of times.

Profiting From the Decline

Remember, my goal in the Weekly Options Corner is to keep things simple. We don’t want to get caught up in the terminology of options right now.

There are only two options you can buy: call options and put options.

Put options are easy to understand: As a stock declines, put options go up in value.

New traders often grapple with put options and how they rise in value while the underlying stock falls.

Don’t overthink it. Put options are designed to give you that bear market opportunity. They’re designed to rise in value as the stock you bought the put option on falls in value.

A put option is for when stocks are going down. Call options are for when stocks are going up.

Don’t Wait for the Bear Market

So let’s talk about why you’d use a put option.

If you’ve been investing in the market for a while, you’ve probably noticed that pullbacks tend to be shorter than rallies.

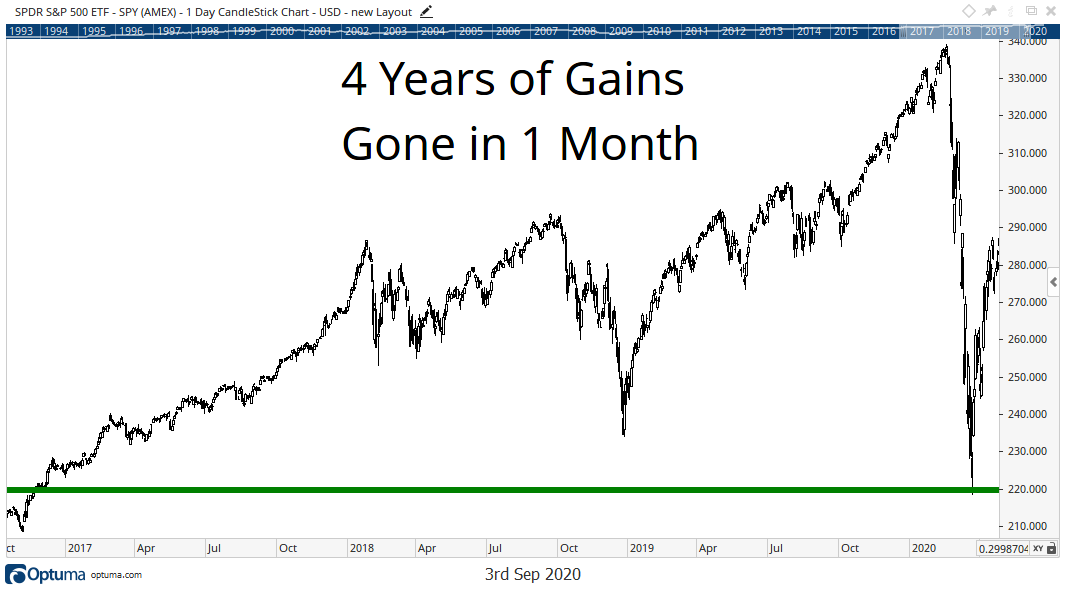

Take the decline at the start of this year. The S&P 500 Index dropped 34% in just one month.

It temporarily wiped out nearly four years’ worth of gains. You can see why this keeps investors up at night:

But, if you waited for the stock market to hit bear market territory before buying put options, you would have missed out on your chance at profits. Wall Street doesn’t declare a “bear market” until after there’s been a 20% drop. Remember, you only had one month to trade the move. If you’d waited until the bear market was confirmed, you’d have missed out on some stellar opportunities.

I factor put options into the strategies I design because they give you an edge. Put options let you make money as the stock market is losing value. That is the No. 1 way to outperform the market.

And with many pullbacks within any given year, you can use put options every year to be in a position to capitalize on any declines that occur.

You just have to have the right strategy to take advantage of these opportunities.

Your Weekly Options Corner

Again, we started the Weekly Options Corner to show you how to trade options from the ground up. These first few weeks are just the basics. We’ll dive into more options concepts in the coming weeks as we continue to establish the fundamentals of options trading.

Then, we’ll look at putting these ideas into action with some real trades in the next month or two.

Next week, I’ll talk about why you don’t need to be overwhelmed with options symbols. There’s an easy, straightforward way to pick the perfect option for a stock you want to trade on — and I’ll show you.

Thanks for all the emails we received this week. It is great to see what everyone wants out of these weekly emails. And I’m sure you’ll find them even more beneficial as we get deeper into understanding options.

We’ll talk more about how to spot potential trades using my premium strategies and get into a few actual trades in the coming months.

Let us know what you think of these weekly issues. Are they helpful for those of you just beginning to understand options? Are you excited to dive into deeper concepts such as option strategies and finding potential trades?

You can send me an email to WinningInvestor@BanyanHill.com.

I look forward to diving into more options insights with you next week!

Regards,

Chad Shoop, CMT

Editor, Quick Hit Profits