The markets are closed for the Memorial Day holiday, but it doesn’t mean there’s not a lot going on.

Last week, we saw a ton of unusual options activity.

Unusual options activity is traders making big bets outside of earnings plays. It’s common to see big bets around earnings because earnings can be a catalyst for a big move in the stock. Unusual options activity is when big bets happen without an obvious reason.

There are still some smart traders like I highlighted last week in Tesla (Nasdaq: TSLA), where they are selling options for a premium (yield, essentially). Plus, there’s some heavy hitters using several straddles to capitalize on some upcoming big moves in a stock.

But today, I want to highlight a few areas of activity that were pure directional bets on a few specific stocks.

Let’s dive in…

The First

On Tuesday last week, someone purchased $1.2 million worth of Roblox Corporation (NYSE: RBLX) out-of-the-money call options. Out-of-the-money means the strike price is significantly higher than what shares are currently trading for. So, this trader expects a big move.

They scooped up the June 18, 2021 $110 calls for about $2 a pop. With more than 6,000 contracts traded (and 100 shares per contract), that equals a more than $1.2 million bet that the stock would rise significantly over the next three weeks.

By Thursday, these options were trading for as much as $3.50 after the stock jumped more than 9% on the day.

That’s a profit of $900,000 in just two days!

But this trader wasn’t selling because we could see that the open contracts remained well over the 6,000 they purchased. If they had sold their options, it would have showed up in the volume for the day.

They must have a very good reason to keep holding what amounts to basically a million dollar profit.

And while I was looking into this activity, I noticed other strikes for the June 18th expiration were getting heavy volume as well — calls on the $110, $115, and $120 strike prices all experienced a ton of action.

This is unusual because these strike prices are 25% to 35% above where the stock was trading when the trades were placed. So, they were very out-of-the-money.

Whoever is buying these options picked an out-of-the-money strike price for a reason — they believe the stock can climb even higher over the next three weeks.

Another One

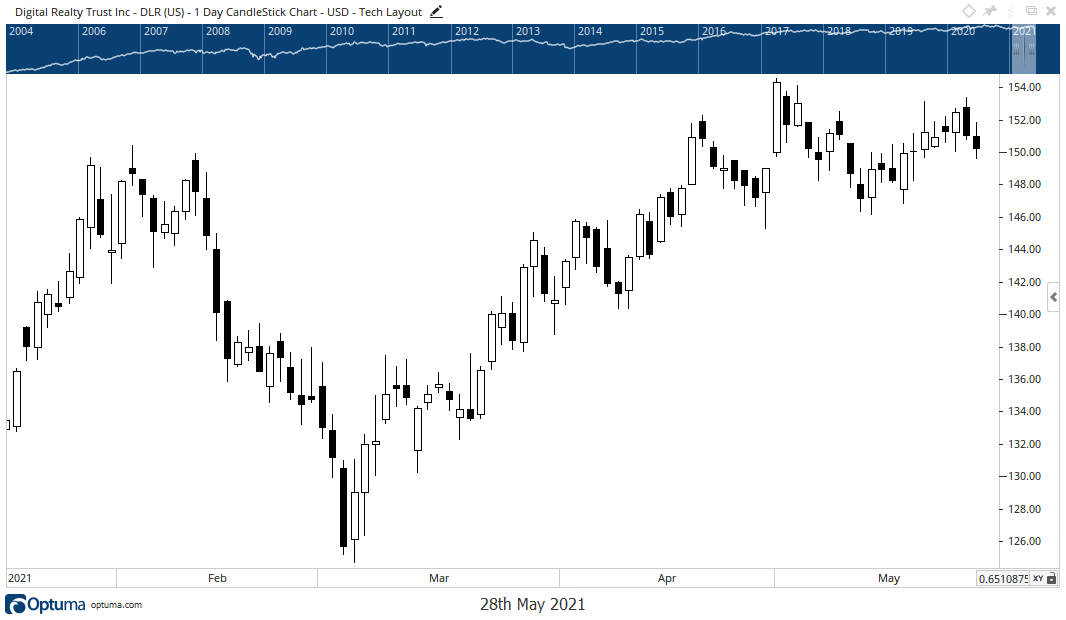

On Wednesday, we had more unusual options activity, this time in Digital Realty Trust (NYSE: DLR).

This time, it was a single trader making a heavy bearish bet on the stock. I know that was the case because it was one order for 6,000 contracts.

The trader wasn’t as urgent with this trade, seeing as the expiration they picked was the October 15, 2021 date — more than four months away.

They purchased the October 15, 2021 $125 put options for about $1.62. With exactly 6,000 contracts being purchased, we are looking at a $972,000 bet on Digital Realty shares to drop like a rock.

The stock has been trading around $150 per share. To hit breakeven, the stock has to fall 17% over the next four months.

That would bring it back to its previous lows in March as the trader looks for a reversal of the current rally. It’s well within reach if the stock tops out around this $150 price range.

One More

Last Thursday there was a nice $1.14 million bullish bet made on Spirit AeroSystems Holdings (NYSE: SPR).

This trader grabbed the June 18, 2021 expiration which is just three weeks away. They went with 4,000 of the $48 call options for $2.85.

Again, just one big trader making a splash in the options market. They laid down $1.14 million betting on this aerospace stock will soar and soar fast.

And this unusual activity came after a sharp 5% jump in the stock on Thursday. No major news came out yet, but with over $1 million on the table, it’s safe to assume this trader knows something is up.

After all, that’s why we follow unusual options activity — to follow the money.

And right now, these are three stocks to keep on your radar.

Regards,

Chad Shoop, CMT

Editor, Quick Hit Profits

P.S. Take a look at my new video on my Shakeout Profit strategy if you haven’t already.