Footonomics by Jakobsen & Garnry is about the serious and fun differences on macro and equities between two countries playing in the UEFA EURO 2020 tournament.

Match: Spain vs Sweden

Macro: La Furia Roja vs. Blågult

- Sweden takes a massive win on Misery Index (CPI + Unemployment + Budget deficit) with 13.1 score vs. Spain’s 26.7, pretty miserable in Spain!

- Spain is ranked 15th in GDP on PPP basis vs. Sweden at 40th – big Spain win.

- Sweden’s Anders Frisk has most refereed matches: 8 (1994-2004) and Zlatan Ibrahimovic has most tournaments with at least two goals. 3 times for Zlatan.

- Spain win in most Championships,3, and longest gap between winning 44 years.

- Clean Spain win although Zlatan, of course, will claim his record more important.

- Best football quotes: Sweden: Zlatan: TV4 reporter: “Who will win the qualifier? Zlatan: “Only God knows”. Reporter: “Its kind of hard to ask him”. Zlatan: “You are talking to him”….Spain: Xavi: “Most players I came across were quicker and stronger than me. Decision making is what controls our physical actions. Some have mental speed of 80 while others are capable of reaching 200, I always tried for 200”. Well, its not hard is it, as much as we love Xavi, there is only one Zlatan, God or not: Sweden wins.

- Macro is a draw, but small edge for Spain based on size and history. Sorry Zlatan.

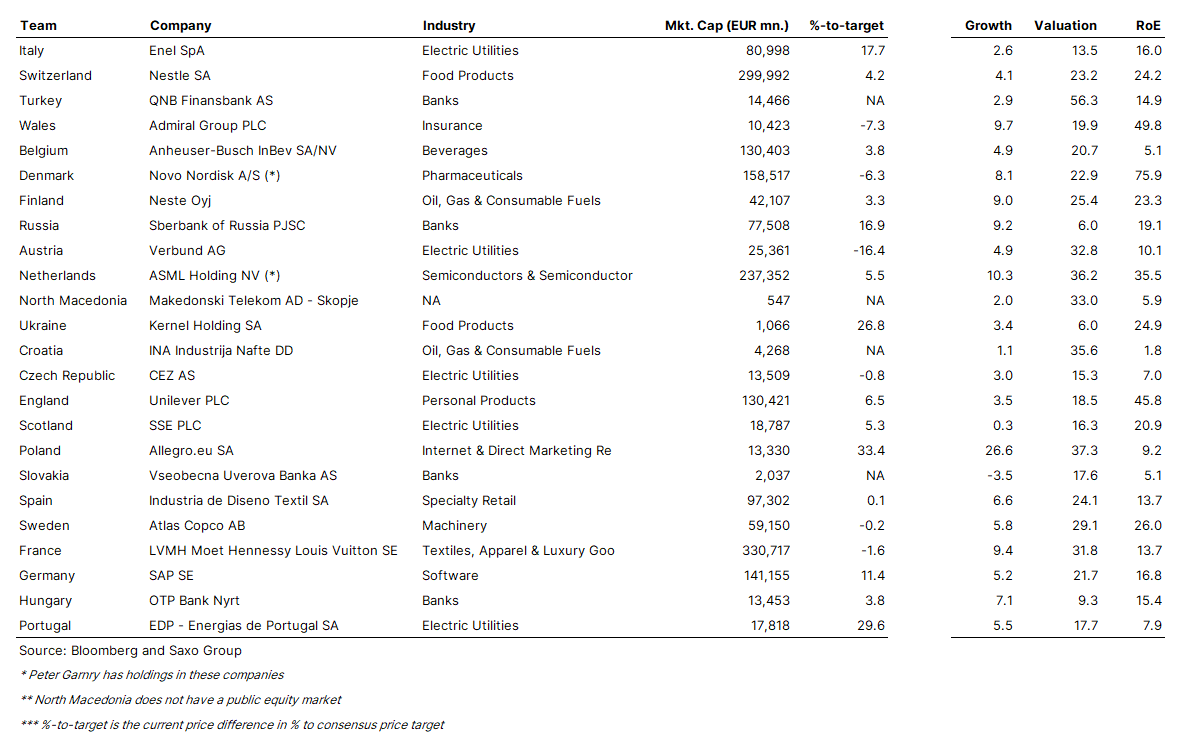

Equities: Inditex vs Atlas Copco

- Inditex, the parent company of the Zara fashion retailer, wins narrowly 2-1 over Atlas Copco, Sweden’s largest industrial company, as Inditex is cheaper on valuation (24.4 vs 29.4 on 24-month forward P/E ratio) and has a higher expected growth rate (7.1% vs 5.8%). Atlas Copco is a well-run company with a return on equity of 26% easily beating Inditex at 13.7% which has been suffering during the pandemic as the company has underinvested in its e-commerce channels for years.

- Inditex saw during the pandemic how important it is to have a larger footprint in e-commerce despite fashion traditionally being a physical experience. Convenience beats experience in many industries. The latest quarterly result from Inditex shows that the reopening is having a positive impact on the business but the e-commerce business remains an open wound.

- Atlas Copco is strong industrial company that managed well during the pandemic with the 12-month trailing revenue back above SEK 100bn demonstrating an impressive 20% free cash flow generation on that those revenue. The company’s strongest IP and assets remain in its Compressor Technique segment.