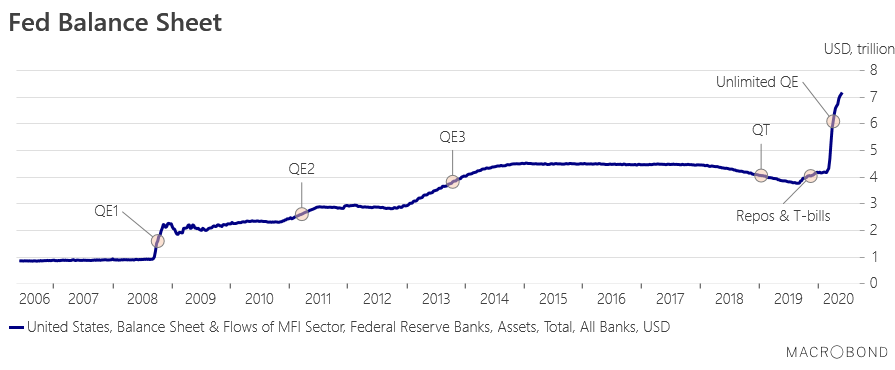

Today’s chart is all about the Federal Reserve. The central bank has injected so much liquidity into the system to face the impact of the pandemic that in just three months its balance sheet has expanded by more than $3tr – becoming the largest in the world. At current path, we expect that the Fed’s accommodative stance and unlimited QE will result in its balance sheet reaching about $10tr by the end of the year, which represents roughly 50% of U.S. GDP. For the time being, monetary policy should be on autopilot mode with little new action from the Fed tomorrow. The central bank is basically adjusting on a day-to-day basis its nine main facilities to make it more attractive and efficient, with a strong focus on the Main Street Lending Program and the Municipal Bond Lending Facility. Yesterday, the Federal Reserve expanded its Main Street Lending Program, worth $525bn, to allow more small and medium-sized businesses to be able to receive support. Among the main changes, minimum loan amount has been lowered to $250k versus $500k previously, the length of loan has been extended from 4 years to 5 years and payments have been deferred for 2 years, up from 1 year previously.

Since the April meeting, the U.S. economic situation has sharply deteriorated. Yesterday, the NBER Committee confirmed the United States entered into recession in February 2020, putting a definitive end to the longest expansion in the history of U.S. business cycles dating back to 1854. In the past few months, economic activity has declined to an unprecedented path, unemployment has risen sharply and inflation has declined to such a level that risk of deflation is becoming real. After not publishing economic forecasts in March, the FOMC will presumably remain cautious regarding the economy’s path and will probably downplay the likelihood of a V-shaped recovery. A very moderate rebound could materialize in H2 on the back of the reopening of the economy, but downside risks are still elevated (e.g. wave of bankruptcies, second wave of the virus, increase pressure on bond yields etc.), which tends to confirm that more will be needed at monetary and fiscal policy levels in coming months. As long as the Federal Reserve does not get a better sense of the state of the economy, we think it is unlikely it will resort to new monetary policy tools, such as negative interest rates and yield curve control (YCC). At this week’s FOMC meeting, there should be no long talk about negative interest rates or any suggestion about accepting them soon. On the contrary, we think that discussions about YCC started at the previous meeting will probably continue. YCC is the next step of the Fed’s monetary policy in order to avoid that existing pressure on longer term bond yields increases further, which could put at risk the recovery.